PRESS RELEASE

Almaty

At the end of December 2010, Nurbank increased its authorized capital by 95.5 billion tenge (approximately $650 million). The bank became one of the largest Kazakhstani banks by authorized capital volume—129.6 billion tenge, ranking 5th among Kazakhstani banks by this financial indicator. According to Nurbank's Chairman of the Board, Marat Zairov, such a significant increase in authorized capital had not occurred in the domestic banking sector for the past three years. “Undoubtedly, the recapitalization was a direct confirmation of the new shareholders’ decision to invest in the bank's development,” noted Mr. Zairov.

Considering the high capitalization, the bank is optimizing its loan portfolio by increasing provisions, which will inevitably affect financial results for the past year. This step indicates a strict credit risk management policy.

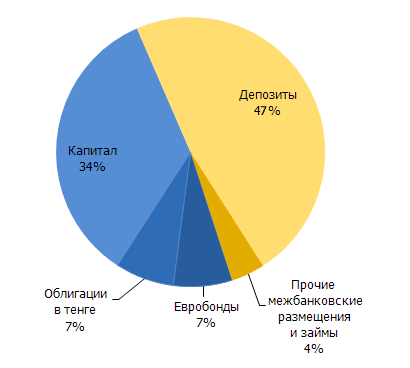

Moreover, throughout the year the bank has timely and fully met all its obligations to clients. Therefore, in accordance with the commitments made, the 8th issue of debt securities was redeemed. The volume of highly liquid assets is expected to be over 25% as of January 1, 2011. During this year, the bank plans to independently redeem issued subordinated bonds worth 4 billion tenge and Eurobonds worth $150 million. Thus, Nurbank expects to fully settle its external obligations. Currently, the bank's debt to external creditors (excluding Eurobonds) is minimal, amounting to 2.7 billion tenge. The bank's funding structure is as follows:

More than 80% of the bank's securities portfolio consists of government securities, which also reflects the bank's conservative policy at present.

In the bank's deposit portfolio, term deposits account for 71%; the share of corporate deposits is 75%. In the loan portfolio, loans to corporate entities account for 85%. This year, Nurbank plans to increase its market share in both the retail sector and the SME segment. By loan and deposit volume, the bank holds 3% of the market share among Kazakhstan's second-tier banks.

As of January 1, 2011, Nurbank has 16 branches, 53 banking service centers, and 333 ATMs.

This year, the bank aims for active development as a universal bank providing a full range of financial services to the population and business structures of Kazakhstan. Nurbank also plans to modernize its product line for both individuals and corporate entities.

Nurbank's plans are supported by the invitation of a team of experienced top executives to key positions. Rauan Daukenov, overseeing international relations, treasury, and subsidiary activities, has extensive experience in Kazakhstan's financial sector. He has worked in the corporate sector and government regulatory financial structures, such as the Treasury System of the Ministry of Finance of the Republic of Kazakhstan, the National Bank of the Republic of Kazakhstan, and the National Securities Commission and brokerage firm Money Experts. Mr. Daukenov graduated from the Kazakh Economic University named after T. Ryskulov and earned an MBA from a European business school—Reims Management School (France). He holds a certificate in International Accounting Standards (England).

The corporate business is overseen by Saken Akhmetov, who has substantial experience in both banking and the corporate sector. From 1995 to 2002, he worked at Halyk Bank of Kazakhstan, directly involved in structured finance, working with the SME sector and large corporate clients. This experience allowed him to transition to leading positions in the corporate sector in 2002. Since summer 2010, he has been the Managing Director of Nurbank.

Maksud Tenbayev, responsible for the development of retail business and branch network, joined the bank from his position as Director of the Karaganda branch of Kaspi Bank. He has been in the banking industry for over 9 years, starting as a senior manager in the banking card development department at Halyk Bank of Kazakhstan. He has practical management experience. Mr. Tenbayev graduated from the Kazakhstan Institute of Economics and Law with a specialization in Finance and Credit.

According to Nurbank's Chairman of the Board, Marat Zairov, with shareholder support, the bank aims to achieve leading positions in Kazakhstan's banking sector. “Today, we have substantial grounds for such a statement,” emphasized Mr. Zairov.

We remind you that in May 2010, a transaction was completed in which Sarsenova S. T. acquired over 70% of Nurbank's shares. Then, at an extraordinary general meeting of bank shareholders on June 8, 2010, a new Board of Directors was elected. It currently includes Raushan Yerzhanova as Chairman of the Board, Eduard Kreimer, and independent director Alexander Frolov.

The change of shareholders has not led to substantial changes in the bank's strategy. The primary priority of Nurbank's activities remains forming a universal financial credit institution with a high level of customer service and a comprehensive approach to selling quality banking products and services.