Nur Business Internet banking is designed to simplify business operations and give you more time to implement ideas and projects.

What does our application offer?

User-friendly interface and 24/7 access

- Statement generation (import statements into 1C)

- Account renaming

- Generation of deposit account ledger

Full control of finances

- Transfers to counterparties

- Transfers between your accounts

- Payment of pension, social, and tax contributions

- Salary and other payments to employees

Security

Purchase/sale of foreign currency

Available Services

- Open an account at the bank branch

- Issue an NCA RK digital signature key

- Complete the application at the Bank branch to connect to Nur Business

- Login via the link

https://nurbusiness.nurbank.kz/

Done. Manage company accounts from anywhere in the world 24/7!

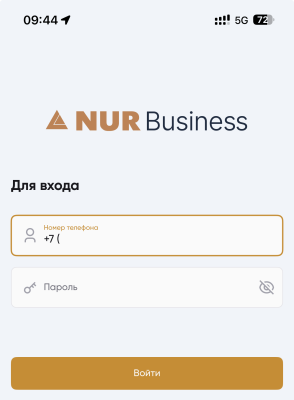

Download the NUR Business app for legal entities and individual entrepreneurs

Open and authorize, or log in with authorized credentials

Frequently Asked Questions

- How to connect to CORREQTS Internet Banking?

- For existing clients - contact your account manager.

- For new clients - visit a Bank branch to open an account.

- What to do if the company changes its authorized person?

Provide the Bank with documents to change the authorized persons.

- What to do if the authorized person's mobile phone number has changed?

Inform the Bank about the change of the mobile phone number.

- What are the benefits of CORREQTS internet banking?

-

Convenient Interface and 24/7 Access

All key functions—from fund transfers to transaction monitoring—are accessible with a few taps. Its ease of use allows you to effortlessly manage your accounts and payments, no matter where you are.

-

Comprehensive Financial Control

Generate account statements to track transactions, helping you make informed decisions and plan budgets.

-

Security

We provide multi-level protection for your data using advanced encryption technologies. Your finances are securely protected.

- What services are available in CORREQTS internet banking?

-

Payments and transfers – perform intra-bank transfers between your accounts and to other accounts.

-

Employee salary payments – create and authorize payroll transactions in a few minutes.

-

Tax, social, and insurance payments in seconds from your smartphone.

-

Access to directories.

- What to do if the account is blocked?

Click 'Reset Password', enter the user's phone number, create a new password for login. Confirm the action with a one-time code.

- How to access CORREQTS for the first time

- What to do if the confirmation code does not arrive?

Call 2552 or your account manager.

- Can multiple payment documents be signed with a single confirmation code?

Yes, they can. The system allows sending multiple created payment documents to the bank simultaneously, and when they are selected together, the system sends only one confirmation code.